Weekly Update

January 12, 2026

Upcoming Events

Monday, January 12

Williams Speaks at Council on Foreign Relations Event

Tuesday, January 13

Consumer Price Index Release

Wednesday, January 14

Producer Price Index Release

Miran Speaks at Delphi Economic Forum

Williams Speaks at New York Fed Event

Paulson Speaks at Chamber of Commerce for Greater Philadelphia Event

Thursday, January 15

Barr Speaks at the Wharton School of the University of Pennsylvania Conference

Friday, January 16

Industrial Production and Capacity Utilization Release

Bowman Speaks at New England Economic Forum

Jefferson Speaks at Florida Atlantic University/American Institute for Economic Research/Shadow Open Market Committee Conference

Saturday, January 17

Blackout Period Begins

Recent News

Under pressure… The Department of Justice served the Federal Reserve with grand jury subpoenas last Friday, Fed Chair Jerome Powell acknowledged in a video recording released last night. The DOJ is investigating statements Powell made before the Senate Banking Committee last June related to the Fed’s $2.5 billion renovation of its office buildings.

Powell cast the subpoenas as an effort to undermine the central bank’s independence:

I have deep respect for the rule of law and for accountability in our democracy. No one—certainly not the Chair of the Federal Reserve—is above the law. But this unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure. This new threat is not about my testimony last June or our about the renovation of the Federal Reserve buildings. It is not about Congress’s oversight role. The Fed, through testimony and other public disclosures, made every effort to keep Congress informed about the renovation project. Those are pretexts.

The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public rather than following the preferences of the President. This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions or whether, instead, monetary policy will be directed by political pressure or intimidation.

I have served at the Federal Reserve under four administrations, Republicans and Democrats alike. In every case, I have carried out my duties without political fear or favor focused solely on our mandate of price stability and maximum employment. Public service sometimes requires standing firm in the face of threats. I will continue to do the job the Senate confirmed me to do with integrity and a commitment to serving the American people.

Employment situation… The economy added 50,000 jobs in December 2025, according to the latest release from the Bureau of Labor Statistics (BLS).

Total nonfarm payroll employment was revised down by 68,000 for October 2025, from -105,000 to -173,000. It was revised down by 8,000 for November 2025, from +64,000 to +56,000.

The labor force was roughly unchanged from November to December 2025, at 171.5 million. The total number of employed persons increased from 163.8 million to 164.0 million. The total number of unemployed persons decreased from 7.8 million to 7.5 million, with the unemployment rate falling from 4.5 percent to 4.5 percent.

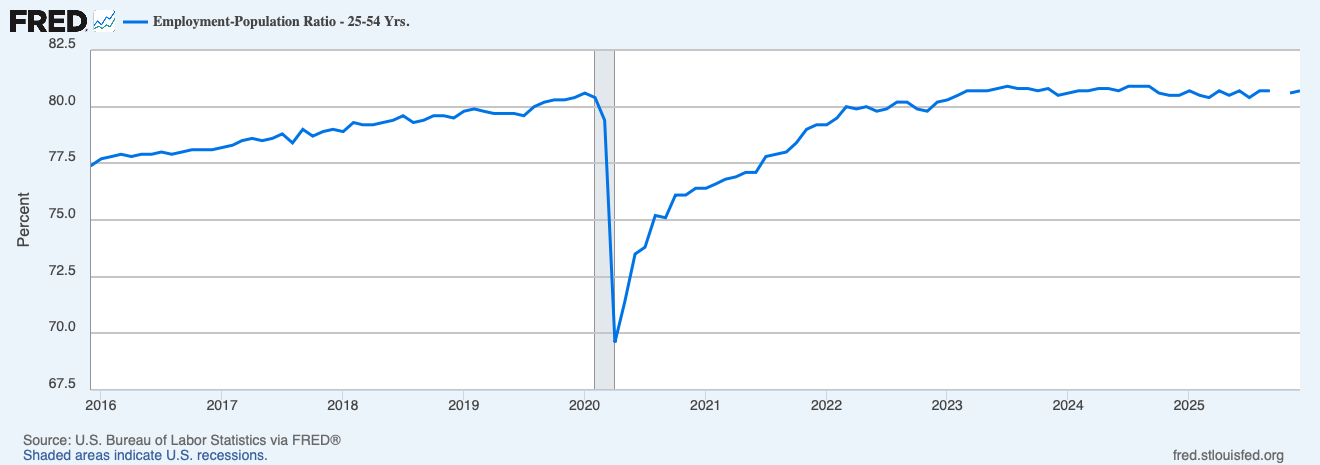

Prime-age employment remains strong. In December 2025, 80.7 percent of those 25 to 54 years old were employed, compared with 80.6 percent in November 2025. For comparison, 80.6 percent of prime-age workers were employed just prior to the pandemic.

JOLTS… The number of job openings declined in November 2025, the BLS reported last week. There were 7.1 million openings on the last business day of the month, compared with 7.5 million on the last business day of the prior month. Job openings have generally declined over the last year. There were 8.0 million job openings on the last business day of November 2024.

According to the BLS, there were 5.1 million hires in November 2025, down from 5.4 million in the prior month. There were 5.1 million separations, roughly unchanged from the prior month.

Within separations, there were 3.2 million quits in November (up from 3.0 million in October) and 1.7 million layoffs and discharges (down from 1.9 million in October).

Mark your calendar… Florida Atlantic University College of Business, the American Institute for Economic Research, and the Shadow Open Market Committee will be co-hosting a monetary conference in Boca Raton, FL on January 16, 2026. Tyler Goodspeed (Chief Economist, ExxonMobil; Former Acting Chair, Council of Economic Advisers) will give the opening address. Philip N. Jefferson (Vice Chair, Federal Reserve Board of Governors) will give the keynote address.

The full schedule is available here. Registration is free and open to the public, but seating is limited. We hope you can join us!