Weekly Update

January 26, 2026

Upcoming Events

Tuesday, January 27

FOMC Meeting

Money Stock Measures Release

Wednesday, January 28

FOMC Meeting and Press Conference

Friday, January 30

Producer Price Index Release

Bowman Speaks at SW Graduate School of Banking at SMU Cox Assembly for Bank Directors

Recent News

All rise… The Supreme Court heard arguments last week related to the attempted firing of Federal Reserve Governor Lisa Cook. The Trump administration is appealing the preliminary injunction issued by District Judge Jia Cobb last September, which permitted Cook to remain at the Fed while her trial plays out.

The Federal Reserve Act permits the president to fire a Fed governor for cause. However, it does not define the term “cause” nor indicate what process the president must follow.

The Trump administration argued that “[d]eceit or gross negligence by a financial regulator in financial transactions is cause for removal”:

In a two-week period in 2021, Lisa Cook submitted mortgage applications for two properties in Michigan and Georgia. In both, she told the lender that, within 60 days, she would occupy that property for one year as her principal residence.

As President Trump stated in removing her, it is inconceivable that she intend -- she was unaware of the first commitment when making the second, and it is impossible that she intended to honor both. Such behavior impugns Cook’s conduct, fitness, ability, or competence to serve as a governor of the Federal Reserve.

The American people should not have their interest rates determined by someone who was, at best, grossly negligent in obtaining favorable interest rates for herself.

Cook’s conception of cause contradicts the term’s longstanding meaning and overrides Congress’s deliberate decision not to impose the inefficiency, neglect, or malfeasance standard here. Her claim that she has a property interest in her public office was roundly rejected by the founding generation as pernicious in a republican system of government.

Her claim that the statute grants her notice and a hearing contradicts this Court’s cases requiring very clear and explicit language to restrict the president’s removal power. And any such process would be futile because, for months, she has never personally disputed the substantial truth of the material in question.

Finally, the remedy she obtained, a preliminary injunction countermanding the president’s decision and reinstating her to office, violates longstanding principles of equity and was conspicuously nonexistent in our nation’s history from 1789 until 2025.

Cook’s attorney said “The Federal Reserve is a uniquely structured entity with a distinct historical tradition”:

Part of that historical tradition is an unbroken history going back to its founding in 1913 in which no president, from Woodrow Wilson to Joseph Biden, has ever even tried to remove a governor for cause, despite the ever-present temptation for lower rates and easier money. Even in this case, the president recognizes the unique status of the Fed by neither arguing that the removal restriction is unconstitutional, nor asserting the ability to remove a Fed governor without cause.

But despite that recognition, the sum total of the Solicitor General’s arguments would reduce the removal restriction in this unique institution to something that could only be recognized as at-will employment. No procedural due process before removal. No judicial review after removal. No preliminary injunction to preserve the status quo. And a conception of cause so capacious that apparent misconduct or gross negligence suffices.

That makes no sense. There’s no rational reason to go through all the trouble of creating this unique quasi-private entity that is exempt from everything from the appropriations process to the civil service laws just to give it a removal restriction that is as toothless as the president imagines.

But, if that removal restriction has real substantive and procedural bite, then this emergency application should be denied. There is simply no reason to abandon over a hundred years of central bank independence on an emergency application on a preliminary record.

The Supreme Court will likely limit its decision to whether the preliminary injunction will remain in place while Cook’s case proceeds through the lower courts. But it could resolve the issue so as the make those lower court hearings unnecessary.

On deck… The odds on who President Trump will nominate for the top spot at the Fed shifted dramatically again last week. As of Sunday evening, punters on Polymarket were giving Rick Rieder a 46 percent chance of receiving the nomination as Fed chair. Former frontrunner Kevin Warsh (30 percent), Keven Hassett (10 percent), and Christopher Waller (9 percent) round out the top four.

Production… Real gross domestic product (GDP) grew at an annualized rate of 4.3 percent in 2025:Q3, according to the second estimate from the Bureau of Economic Analysis. Real GDP has grown at an annualized rate of 2.5 percent year-to-date.

Production is thought to have remained strong in the time since. The Atlanta Fed’s GDPNow model currently estimates real GDP grew at an annualized rate of 5.4 percent in 2025:Q4. If that estimate holds, real GDP will have grown 3.2 percent in 2025. For comparison, real GDP grew 2.4 percent in 2024.

The latest numbers suggest the economy has grown much faster than Fed officials anticipated. At the December 2025 meeting, the median FOMC member projected real GDP would grow just 1.7 percent in 2025.

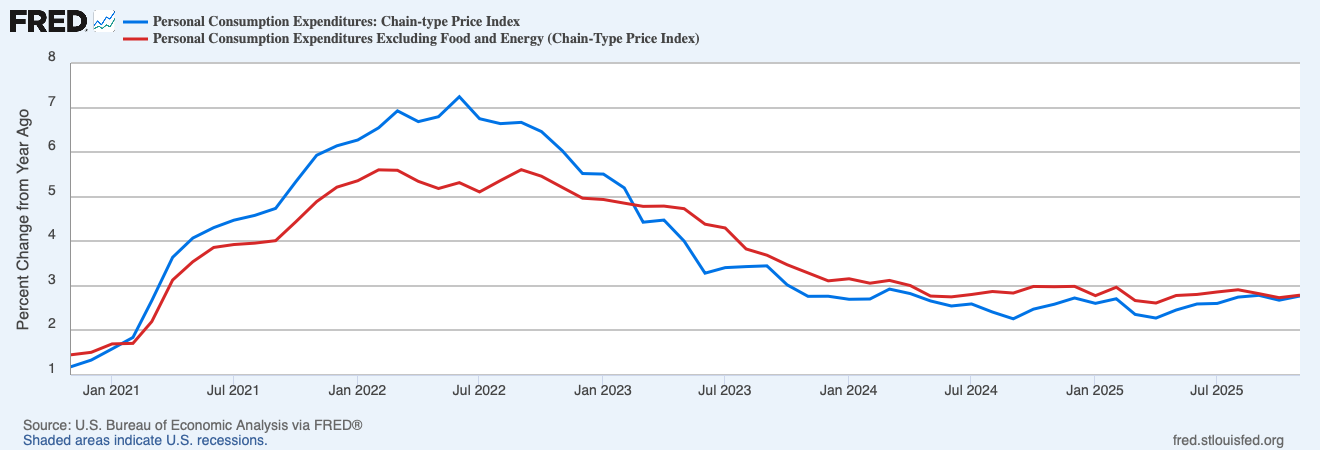

Prices… Inflation picked up in November, according to the long-overdue data from the Bureau of Economic Analysis (BEA) released last week. The Personal Consumption Expenditures Price Index, which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annualized rate of 2.5 percent over the month. It has grown at an annualized rate of 2.7 percent over the last six months and 2.7 percent over the last year.

Core PCEPI, which excludes volatile food and energy prices but also puts more weight on housing services, grew at a continuously compounding annualized rate of 1.9 percent in November. It has grown at an annualized rate of 2.6 percent over the last six months and 2.8 percent over the last year.