Upcoming Events

Tuesday, June 17

FOMC Meeting

Industrial Production and Capacity Utilization Release

GDPNow Update

Wednesday, June 18

FOMC Meeting and Press Conference

Summary of Economic Projections Release

GDPNow Update

Recent News

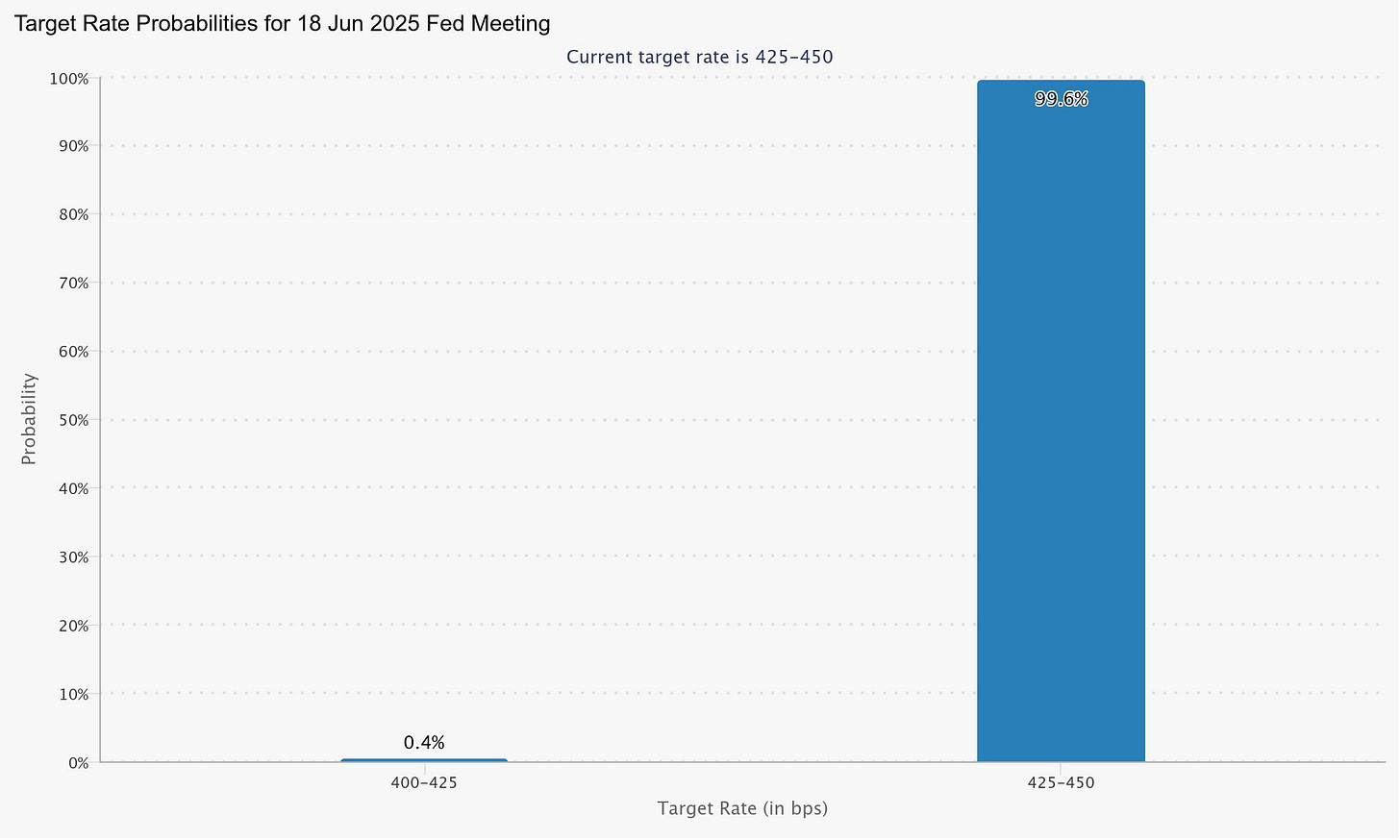

Meeting expectations… The Federal Open Market Committee will likely hold its federal funds rate target range at 4.25 to 4.5 percent when it meets later this week. According to the CME Group, futures market traders are currently pricing in a mere 0.4 percent chance that the FOMC will cut its target rate range on Wednesday.

Fed officials will also report revised projections for inflation, unemployment, real GDP growth and the federal funds rate. Back in March, the median FOMC member projected 2.7 percent inflation of 2025, as measured by the Personal Consumption Expenditures Price Index, and 2.8 percent core inflation. The median FOMC member projected 4.8 percent unemployment and just 1.7 percent real GDP growth.

Fed officials have spoken a lot about policy uncertainty this year, especially as it relates to tariffs and the federal budget. Any revisions this week will provide an indication as to how there perception of those external factors have changed over the last three months.

Prices… Inflation slowed in May, according to new data from the Bureau of Labor Statistics. The Consumer Price Index grew at a continuously compounded annual rate of 1.0 percent in May 2025, down from 2.6 percent in the prior month. CPI inflation has averaged 1.0 percent over the past three months and 2.6 percent over the past six months.

Core inflation, which excludes volatile food and energy prices but also puts more weight on the shelter component, also declined. Core CPI grew at a continuously compounded annual rate of 1.6 percent in May 2025, down from 2.8 percent in the prior month. Core CPI inflation has averaged 1.7 percent over the past three months and 2.6 percent over the past six months.

Survey says… Inflation expectations have fallen, according to the New York Fed’s latest Survey of Consumer Expectations. Median year-ahead inflation expectations were 3.2 percent in May 2025, down from 3.6 percent in the prior month. Year-ahead inflation expectations peaked at 6.8 percent in June 2022, and have gradually fallen in the time since.

In May, consumers said they expected 3.0 percent inflation per year over the three-year horizon (down from 3.2 percent in April 2025) and 2.6 percent inflation per year over the five-year horizon (down from 2.7 percent in April 2025).