Weekly Update

December 22, 2025

Upcoming Events

Tuesday, December 23

Gross Domestic Product Release

Industrial Production and Capacity Utilization Release

Money Stock Measures Release

Thursday, December 25

Merry Christmas!

Recent News

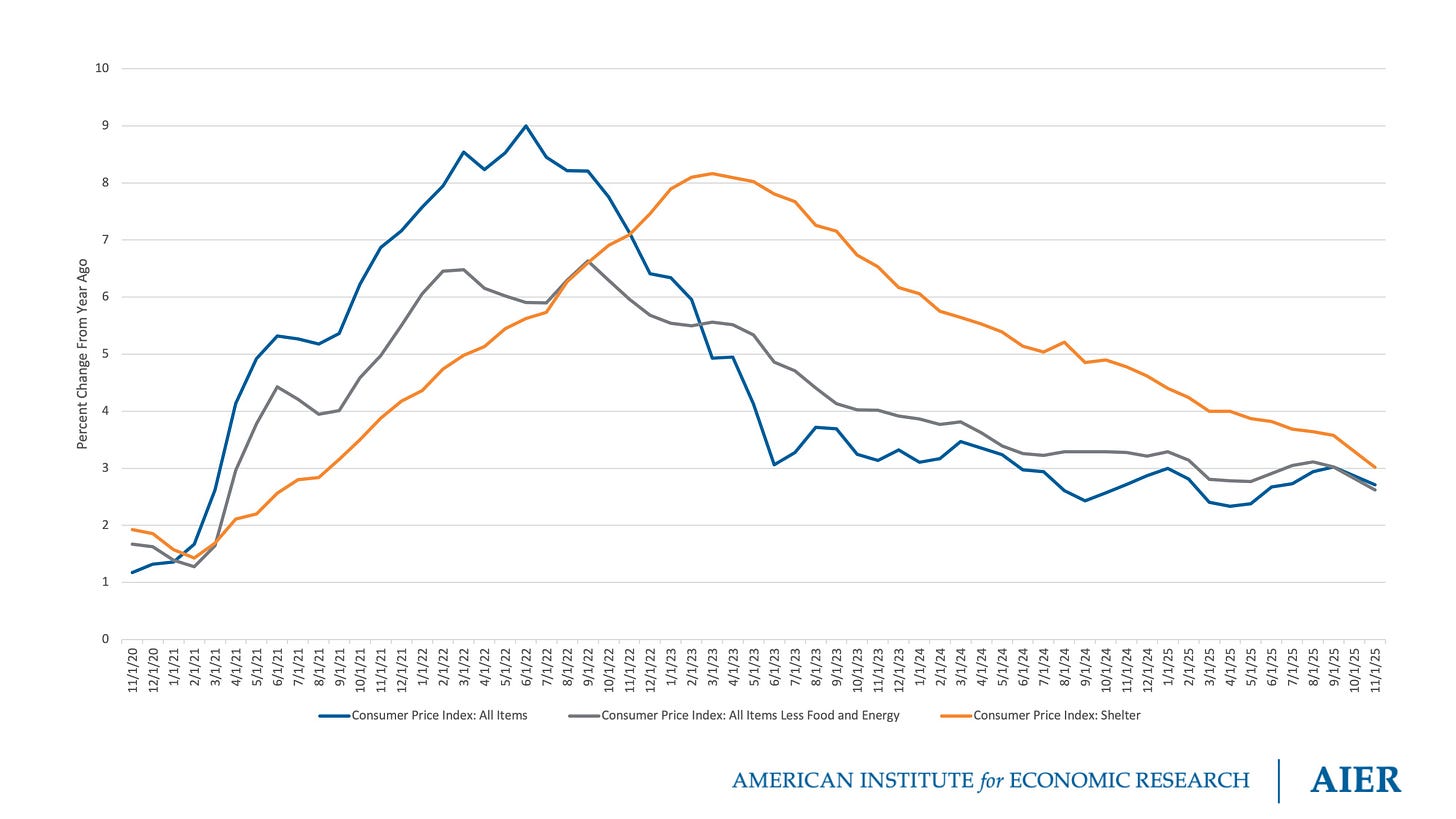

Prices… Inflation dipped in November, according to new data from the Bureau of Labor Statistics released last week. The Consumer Price Index grew at a continuously compounded annualized rate of 2.1 percent over the three months ending in November, down from 3.6 percent for the three months ending in September. Due to the government shutdown, the BLS did not release data for October. CPI inflation has averaged 2.8 percent over the past six months and 2.7 percent over the past twelve months.

Core inflation, which excludes volatile food and energy prices but also puts more weight on the shelter component, decreased as well. Core CPI grew at a continuously compounded annualized rate of 1.5 percent over the three months ending in November, down from 3.6 percent for the three months ending in September. Core CPI inflation has averaged 2.6 percent over the past six months and 2.6 percent over the past twelve months.

Data collection problems owing to the government shutdown suggest a rebound in measured inflation is likely in December. The BLS could not collect survey data for October and appears to have carried forward September data to fill in the missing gaps. That decision, while perhaps the best of available alternatives, likely results in a downward bias in the November reading.

Consider the shelter component of CPI. The BLS reports that the shelter component grew at a continuously compounded annualized rate of 1.1 percent from September through November. It had averaged 3.5 percent over the three months ending in September and 3.3 percent over the six months ending in September.

Note that shelter accounts for roughly 40 percent of the headline CPI basket. Hence, a downward bias in the measured shelter inflation rate of 2.2 percentage points—consistent with the idea that a consistently-measured shelter inflation would have been around 3.3 percent in November—implies a downward bias in the measured headline CPI inflation rate of nearly 0.9 percentage points. Adjusting for this presumed downward bias would put the consistently-measured November headline CPI inflation rate around 3.6 percent—roughly on par with the measured reading for September.

Adjusting for the presumed downward bias in measured November inflation may give one a reading that is more consistent with the pre-shutdown readings. But it does not necessarily give one a reading that is closer to actual inflation.

Consider the shelter component once more. The way the BLS constructs this measure in normal times results in a well-known lag. Following a monetary expansion, measured shelter inflation will initially underestimate actual shelter inflation and subsequently overestimate actual shelter inflation until the two eventually converge. Hence, actual shelter inflation—and actual consumer inflation more broadly—is probably lower than a consistently-measured reading would suggest at present.

Whether the measured November rates are closer or further way from the actual rates than the consistently-measured rates is difficult to assess: there is a downward bias in November and longer-term upward bias that is gradually phasing out. The net effect depends on the magnitudes of the two biases.

My guess is that actual headline CPI inflation is a bit closer to 2.1 percent than 3.6 percent—but closer still to the midpoint (2.9 percent) of the two. If nothing else, the latest release serves as a reminder that we are always dealign with imperfect data.

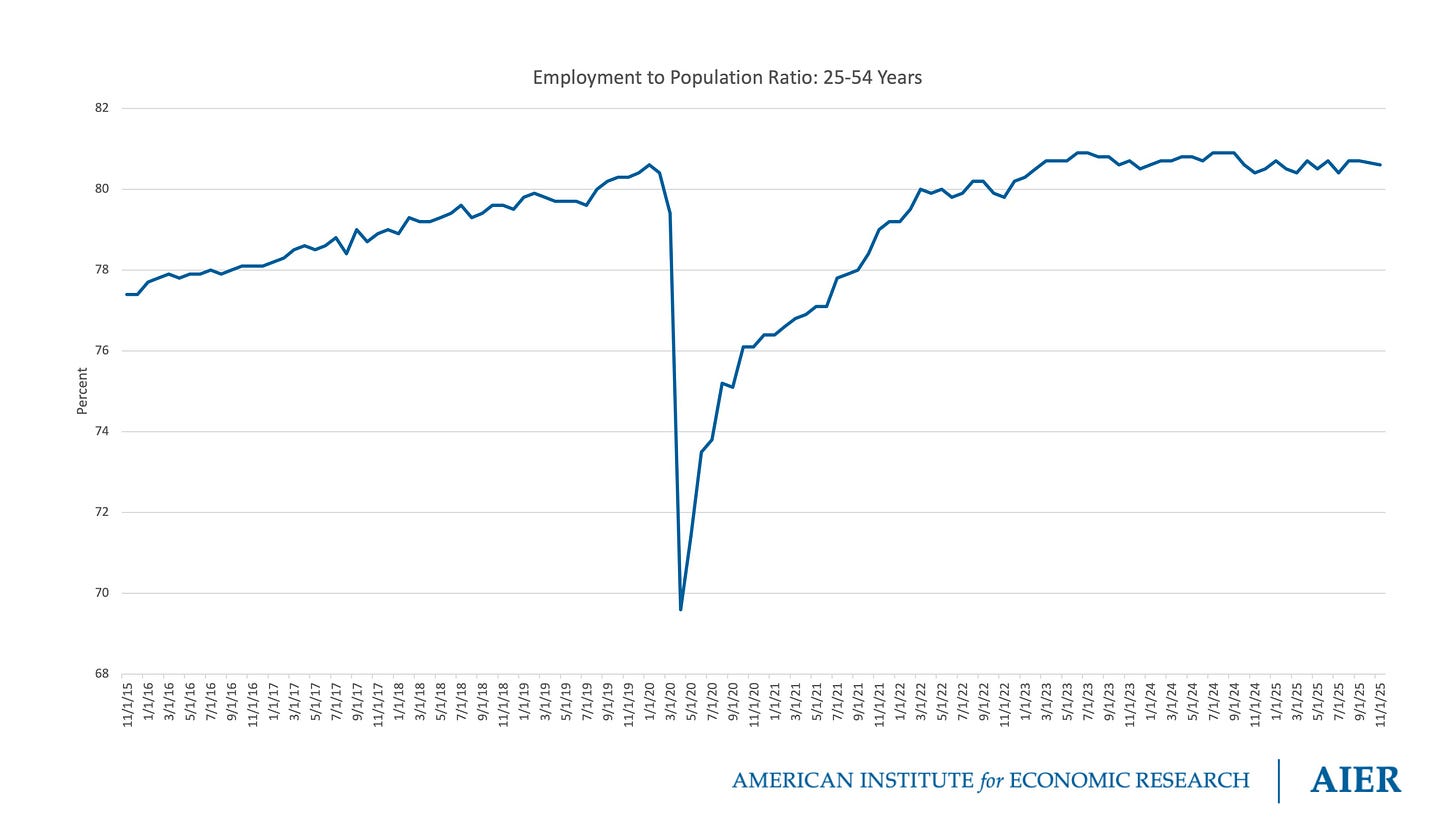

Employment situation… The economy added 64,000 jobs in November 2025, according to the latest release from the Bureau of Labor Statistics (BLS).

Total nonfarm payroll employment was revised down by 22,000 for August 2025, from -4,000 to -26,000. It was revised down by 11,000 for September 2025, from +119,000 to +108,000.

The labor force increased from 171.3 million in September to 171.6 in November, while the total number of employed persons increased from 163.6 million to 163.7 million. The total number of unemployed persons climbed from 7.6 million to 7.8 million, with the unemployment rate increasing from 4.4 percent to 4.6 percent.

Prime-age employment remains strong. In November 2025, 80.6 percent of those 25 to 54 years old were employed, compared with 80.7 percent in September 2025. For comparison, 80.6 percent of prime-age workers were employed just prior to the pandemic.

Mark your calendar… Florida Atlantic University College of Business, the American Institute for Economic Research, and the Shadow Open Market Committee will be co-hosting a monetary conference in Boca Raton, FL on January 16, 2026. Tyler Goodspeed (Chief Economist, ExxonMobil; Former Acting Chair, Council of Economic Advisers) will give the opening address. Philip N. Jefferson (Vice Chair, Federal Reserve Board of Governors) will give the keynote address.

The full schedule is available here. Registration is free and open to the public, but seating is limited. We hope you can join us!