Weekly Update

December 8, 2025

Upcoming Events

Monday, December 8

Survey of Consumer Expectations Release

Tuesday, December 9

Job Openings and Labor Turnover Survey Release

FOMC Meeting

Wednesday, December 10

Employment Cost Index Release

FOMC Meeting and Press Conference

Summary of Economic Projections Release

Thursday, December 11

Producer Price Index Release

Financial Accounts of the United States Release

Friday, December 12

Paulson Speaks at Delaware State Chamber of Commerce Event

Hammack Speaks at University of Cincinnati Real Estate Center Roundtable

Goolsbee Speaks at Chicago Fed Annual Economic Outlook Symposium

Saturday, December 13

Daly Speaks at Institute of International and European Affairs Event

Recent News

Meeting expectations… Markets are pricing in a rate cut at this week’s Federal Open Market Committee (FOMC) meeting. The CME Group reports the market-implied odds of a 25 basis point cut at 88.4 percent.

Back in September, the median FOMC member projected the midpoint of the federal funds rate target range would fall to 3.6 percent this year. But Fed officials have sent mixed signals in the time since.

Last month, Kansas City Fed President Jeffrey Schmid opposed the FOMC’s 25 basis point cut. It is hard to imagine him supporting an additional 25 basis point cut this month. The only question is whether any other FOMC members will join his opposition—and, if so, how many.

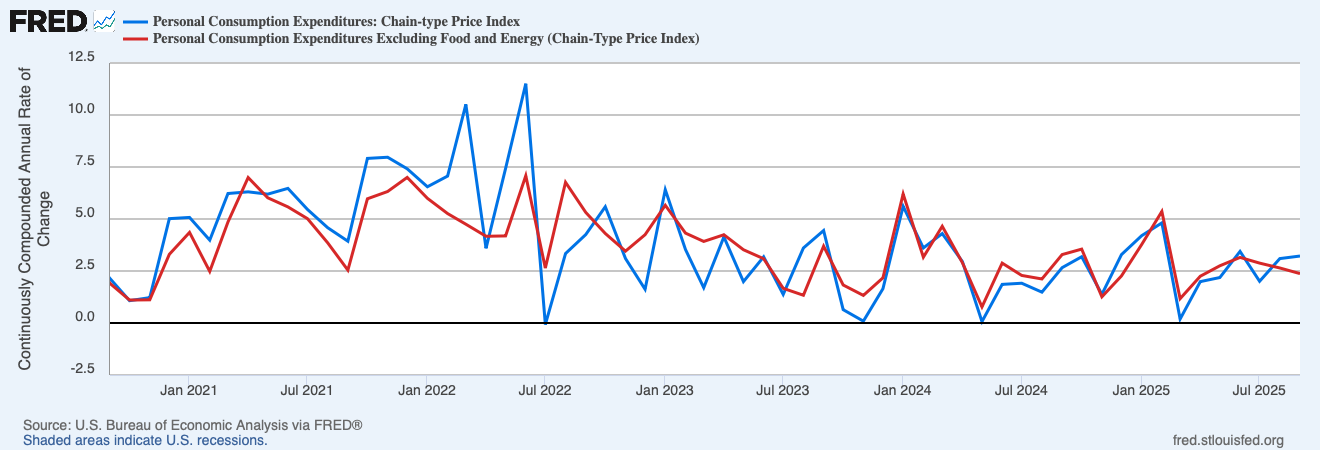

Prices… Inflation continued to rise in September, according to the long-overdue data from the Bureau of Economic Analysis (BEA) released last week. The Personal Consumption Expenditures Price Index, which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annualized rate of 3.2 percent over the month. It has grown at an annualized rate of 2.7 percent over the last six months and 2.7 percent over the last year.

Core PCEPI, which excludes volatile food and energy prices but also puts more weight on housing services, grew at a continuously compounding annualized rate of 2.4 percent in September. It has grown at an annualized rate of 2.7 percent over the last six months and 2.8 percent over the last year.

The September PCEPI release was originally scheduled for October 31, but was delayed by the government shutdown. The BEA has not yet issued a new date for the October PCEPI release, which was originally scheduled for November 26, but has indicated that its November PCEPI release will be delayed as well.