Weekly Update

January 5, 2026

Upcoming Events

Wednesday, January 7

Job Openings and Labor Turnover Survey Release

Bowman Speaks at California Bankers Association’s Bank Presidents Seminar

Thursday, January 8

Survey of Consumer Expectations Release

Friday, January 9

Jobs Report Release

Surveys of Consumers Release

Recent News

Minute details… The Federal Open Market Committee may have misjudged the strength of spending in the economy, the minutes from most recent meeting reveal. If so, they will likely delay further rate cuts.

Let’s start with the FOMC’s December 2025 decision. Although most participants supported lowering the federal funds rate target range, the minutes show a “few of those who supported lowering the policy rate at this meeting indicated that the decision was finely balanced or that they could have supported keeping the target range unchanged.”

Those who favored lowering the target range for the federal funds rate generally judged that such a decision was appropriate because downside risks to employment had increased in recent months and upside risks to inflation had diminished since earlier in 2025 or were little changed. Some of these participants emphasized that lowering the target range for the federal funds rate at this meeting was in line with a forward-looking approach to the pursuit of the Committee’s dual-mandate objectives. These participants noted that reducing the policy rate at this meeting would be consistent with the projected decline in inflation over coming quarters while contributing to a strengthening of economic activity in 2026 that would help stabilize labor market conditions after this year’s cooling.

Looking ahead, FOMC members generally acknowledged that further rate cuts would be required to return monetary policy to a neutral stance, but indicated such cuts were unlikely to come anytime soon.

Most participants judged that further downward adjustments to the target range for the federal funds rate would likely be appropriate if inflation declined over time as expected. With respect to the extent and timing of additional adjustments to the target range for the federal funds rate, some participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for some time after a lowering of the range at this meeting. A few participants observed that such an approach would allow policymakers to assess the lagged effects on the labor market and economic activity of the Committee’s recent moves toward a more neutral policy stance while also giving policymakers time to acquire more confidence about inflation returning to 2 percent.

If anything, the more recent data suggests additional rate cuts will come even later than FOMC members previously expected.

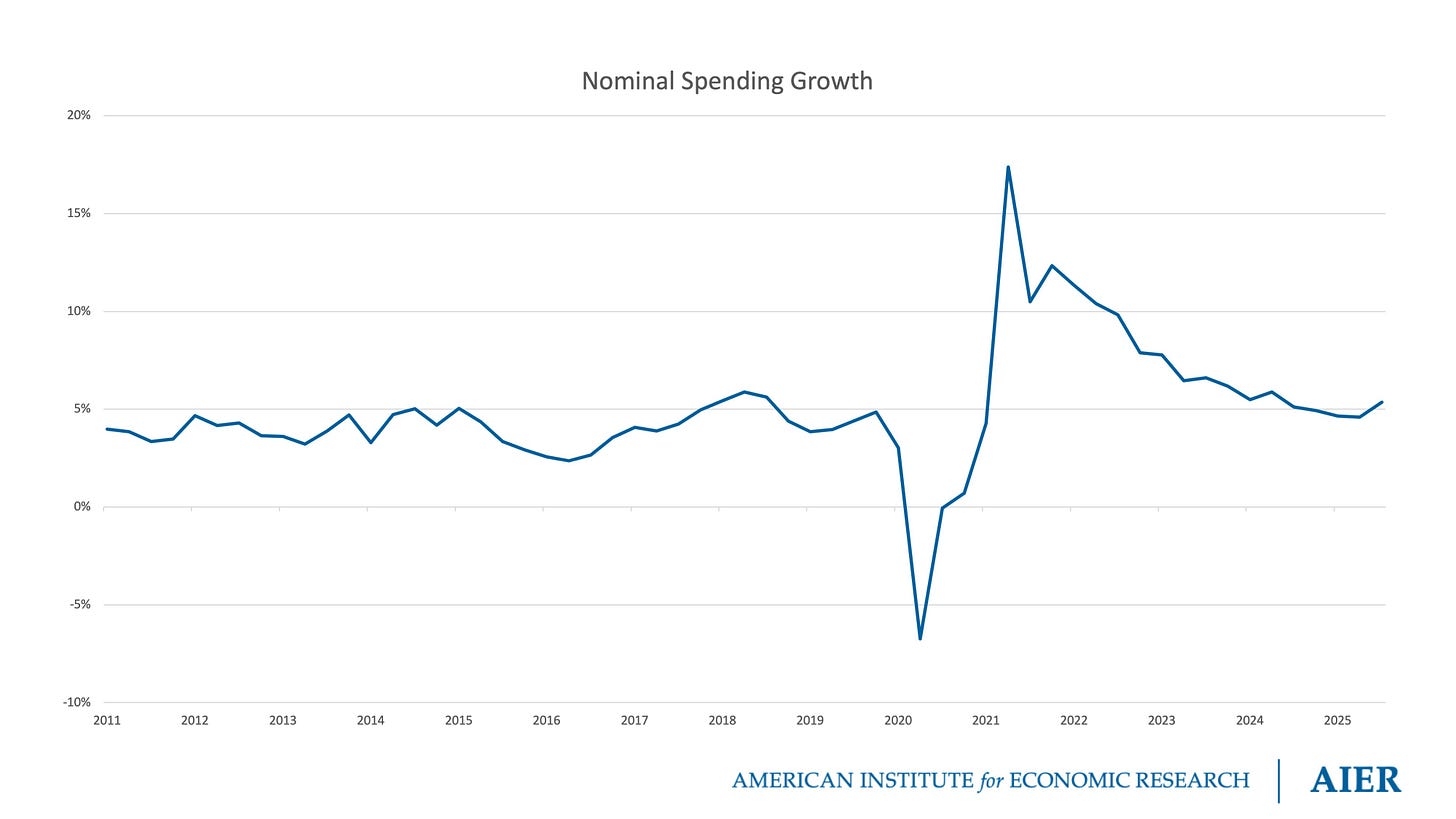

Consider how we got to this point. Nominal spending growth surged in 2021 and remained elevated through mid-2022, when the Fed began hiking rates aggressively. It has gradually declined in the time since. Nominal spending growth averaged 7.6 percent in 2022, 6.0 percent in 2023, and 4.8 percent in 2024.

At the December 2025 FOMC meeting, the median member projected 1.7 percent real GDP growth and 2.9 percent inflation in 2025. Those projections imply that the median member expected around 4.6 percent nominal spending growth for the year—i.e., that the decline in nominal spending growth had continued. That matters: nominal spending growth must continue to fall if inflation is to return to the Fed’s 2-percent target.

Alas, data released following the December 2025 FOMC meeting shows that nominal spending growth has rebounded. In 2025:Q3, nominal spending grew at an annualized rate of 7.9 percent. It has grown at an average annualized rate of 5.6 percent over the three quarters in 2025 for which data is available. To hit the implied projection of 4.6 percent for the year, nominal spending growth would have to fall to an annualized rate of just 1.9 percent in 2025:Q4.

The resurgence of nominal spending growth would seem to validate the concerns of those FOMC members who preferred leaving the federal funds rate target range unchanged in December. According to the minutes, those members worried “that progress toward the Committee’s 2 percent inflation objective had stalled in 2025 or indicated that they needed to have more confidence that inflation was being brought down sustainably to the Committee’s objective.” The latest data offers no such confidence.

Mark your calendar… Florida Atlantic University College of Business, the American Institute for Economic Research, and the Shadow Open Market Committee will be co-hosting a monetary conference in Boca Raton, FL on January 16, 2026. Tyler Goodspeed (Chief Economist, ExxonMobil; Former Acting Chair, Council of Economic Advisers) will give the opening address. Philip N. Jefferson (Vice Chair, Federal Reserve Board of Governors) will give the keynote address.

The full schedule is available here. Registration is free and open to the public, but seating is limited. We hope you can join us!