Summary

Actual Spending: $29.72 trillion

Neutral Spending: $29.52 trillion

Spending Gap: 0.70%

Policy Stance: Moderately loose; Improving

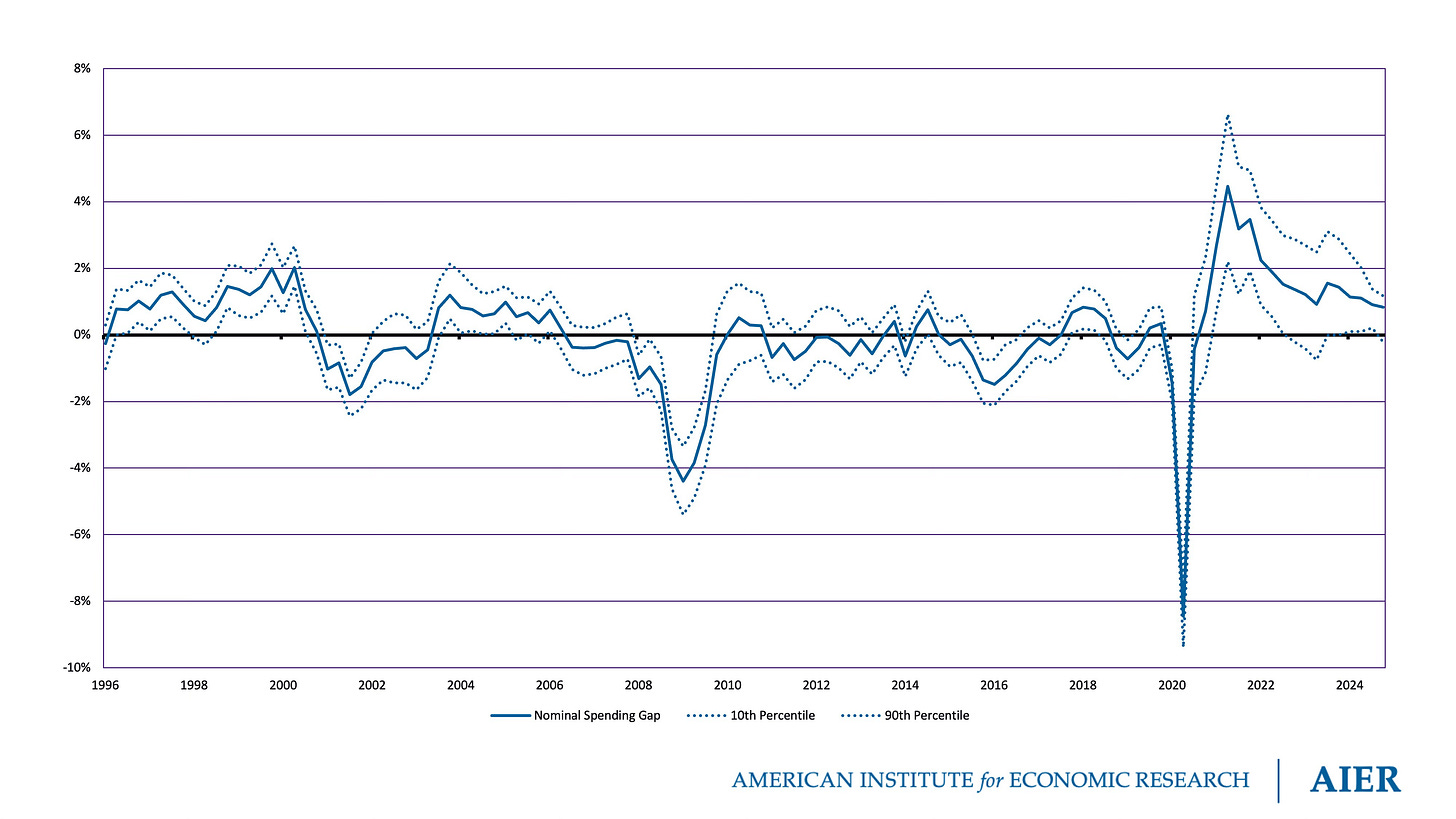

Nominal spending exceeded its neutral level in 2024:Q4, resulting in a nominal spending gap of 0.70 percent. The confidence interval ranged from -0.13 percent (10th percentile) to 1.07 percent (90th percentile). The nominal spending gap suggests that monetary policy remained moderately loose in 2024:Q4.

The nominal spending gap surged to 4.46 percent in 2021:Q2, before declining to 0.92 percent in 2023:Q2. It then rebounded to 1.56 percent in 2023:Q3 and remained elevated at 1.44 percent in 2023:Q4. The decline observed over 2024 suggests that the stance of monetary policy has improved.

Overview

Standard macroeconomic theory maintains that shocks to nominal spending—or, aggregate demand—cause real output to deviate from potential real output. Households and firms temporarily over-produce if nominal spending is greater than they had expected when employment and production plans were made. They temporarily under-produce if nominal spending is less than they had expected. In both cases, expectations ultimately adjust to ensure real output is consistent with potential real output, as determined by the available factors of production, technology, and preferences. But those temporary deviations may impose non-trivial welfare costs on society.

The implications of standard macroeconomic theory for monetary policy are straightforward: the central bank should anchor expectations and then stabilize nominal spending along a path consistent with those expectations. By anchoring expectations, the central bank reduces the risks—and, hence, costs—associated with long term contracts. By delivering nominal spending in line with expectations, it prevents households and firms from being fooled into over-producing or under-producing. Such a policy would not eliminate all macroeconomic fluctuation. In particular, it would not prevent changes in real output that are consistent with changes in potential real output. Nonetheless, it has the potential to improve welfare by eliminating—or, at least mitigating—undesirable macroeconomic fluctuation.

The nominal spending gap tracks the difference between actual and expected (or, neutral) nominal spending. It can be used to judge the stance of monetary policy. When nominal spending is greater than expected, the nominal spending gap is positive—an indication that monetary policy is loose. When nominal spending is less than expected, the nominal spending gap is negative—an indication that monetary policy is tight. When nominal spending is equal to expected nominal spending, the nominal spending gap is zero—an indication that monetary policy is neutral.

Technical Description

The nominal spending gap is defined as

where Nt is the level of nominal spending at time t and Nt* is the neutral level of nominal spending at time t.

Given the equation of exchange, Nt = PtYt, where Pt is the price level at t and Yt is real output at t, nominal spending can be measured as the nominal value of all final goods and services produced—i.e., nominal gross domestic product.

The neutral level of nominal spending in the current period is the level of nominal spending that was expected when existing production plans were made. Given conventional estimates of the expectations-adjustment process and the available data, I estimate the neutral level of nominal spending as

where E(PtYt | Ωt-i) is the expectation of nominal spending at t given the information the median professional forecaster possesses at t-i. Specifically, I average the median forecast of nominal gross domestic product for the current period as presented in the Philadelphia Federal Reserve's Survey of Professional Forecasters over the prior five quarters to estimate neutral nominal spending in the current quarter.

Two periods serve to illustrate the usefulness of comparing the actual and neutral levels of nominal spending. Actual nominal spending fell below the neutral level of nominal spending in 2008, and remained below it for around two years. This implies that monetary policy was tight over the period. As standard macroeconomic theory would predict, real output and the price level fell below their pre-shock growth paths during this period.

Actual nominal spending exceeded the neutral level of nominal spending beginning in 2021, and has remained above it in the time since. This implies that monetary policy was loose over the period. As standard macroeconomic theory would predict, the price level rose above its pre-shock growth path during this period. (A series of real shocks associated with the COVID-19 pandemic, policy responses to the pandemic, supply chain disruptions, and Russia’s invasion of Ukraine kept real output below its pre-2020 growth path during this period. While those real shocks would explain a temporary increase in the level of prices, which would return to trend as output recovered, they cannot account for the observed permanent increase in the level of prices.)

Given the plausible usefulness of comparing actual and neutral levels of nominal spending, I estimate the nominal spending gap. Specifically, I use the aforementioned estimate of the neutral level of nominal spending to calculate the value of (Nt - N̂t*)/N̂t* for each quarter over the period from 1969:Q4 to 2024:Q4.

For additional details and relevant sources, see Luther (2024) “Neutral Nominal Spending and the Nominal Spending Gap,” Sound Money Project Working Paper.